A year ago, many non-profit leaders and industry pundits predicted that charitable giving would decrease as much as $20 billion nationwide because of the new tax law. They were convinced that a reduction in tax rates and the doubling of the standard deduction from $12,000 to $24,000 would discourage individuals from contributing to their favorite charities. As with Chicken Little, they were effectively claiming that the sky was falling.

The team at Columns Fundraising studied the tax law, and we disagreed.

According to Giving USA, charitable giving hit $410.02 billion nationwide in 2017. This included increases to faith-based organizations, health and human services organizations, churches and synagogues, and colleges and universities across the State of Georgia

In 2018, charitable giving grew to $427.71 according to the latest reports from reputable sources like Blackbaud, Giving USA, and the Association of Fundraising Professionals. That’s an estimated increase of $17 billion after the new tax law took affect!

What happened?

Those who believed a decrease in giving was inevitable focused on donors who filed itemized expenses against their Adjusted Gross Income (AGI) when the standard deduction was $12,000. The experts argued that once people received a $24,000 standard deduction, they would be less inclined to support their favorite charities, because the charitable deduction would not provide an additional benefit.

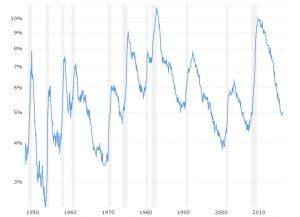

While their argument may have made mathematical sense, it doesn’t take into account human tendencies. What some have called the “Trump Tax Cut” gave middle-income earners an average of $2,500 in extra cash in their paychecks. When people have more money, they tend to be more charitable. It’s a simple equation.

If a donor is in the 28% marginal tax bracket, a $1,000 gift to charity only benefits the donor $280. Would the donor rather have $2,500 in cash, or a $280 tax benefit? If a citizen has a net increase $2,220 in cash, she or he tends to be more charitable.

Conversely, you can’t give what you don’t have. When taxes increase, people have less money to give away.

The pundits’ second miscue was the belief that a large proportion of charitable contributions in the United States come from a percentage of the population who once itemized (using the $12,000 standard deduction). They believed that people would no longer itemize, now that the standard deduction was increased to $24,000. However, that’s not the population who give the lion’s share of charitable across the United States. According to the Association of Fundraising Professionals in a 2017 nationwide study:

4% of all donors give 76% of all charitable contributions—with gifts of $5,000 or more.

14% of all donors give 89% of all charitable contributions—with gifts of $1,000 or more.

33% of all donors give 96% of all charitable contributions—with gifts of $250 or more. Many who considered the impact of the tax change in philanthropy were focused on the effect on gifts under $250. While every gift is important, a gift of this size isn’t as cumulatively important to a nonprofit, or as statistically important in a study.

Overall, giving increased at various levels in 2018; the average gift size increased, and gifts by public and private increased. And mega-gifts, as defined as contributions of $10 million or more, increased by 25% from 2016 to 2017. To be sure, most charitable organizations are not going to be the beneficiary of a mega-gift, but the fact that only 4% of donors contribute 76% of all charitable contributions is a clear illustration of why charitable organizations must stay focused on their existing and prospective major gift donors.

So, why are people still making – even increasing – their charitable giving? Thirty-one percent (29-31%) of all charitable gifts go to religion or faith-based causes each year (still the largest segment of charitable giving according to Giving USA). That number is slightly higher in the South than in the northeast or west coast.

Are these donors giving because of tax benefits? No. Study after study shows that an overwhelming number of Americans give to charities because they believe in the mission of the organization, not because of the tax benefit.

Passion for the mission of an organization drives contributions, not the tax benefits.

We at Columns Fundraising believe that the best way to receive major contributions is to cultivate a strong relationship with a constituent. Stewardship of that relationship through education and engagement of your organization produces beneficial results. Don’t fall prey to political debates, or become overly consumed with what is happening in Washington D.C. And finally, don’t issue emergency cries for help.

Crisis fundraising only works for the Red Cross, because their mission is crisis fundraising. Don’t become another Chicken Little.

Wesley K. Wicker, Ed.D. is a partner and principal of Columns Fundraising, LLC., a full-service consulting firm headquartered in Atlanta. You may contact him at wes@columnsfundraising.com. Wicker earned his Doctor of Education at the Institute of Higher Education at the University of Georgia, M.Ed. in History from Georgia Southwestern State University and a B.A. in History from the University of Alabama.